Full Service Bookkeeping: Essential Financial Services for Your Business

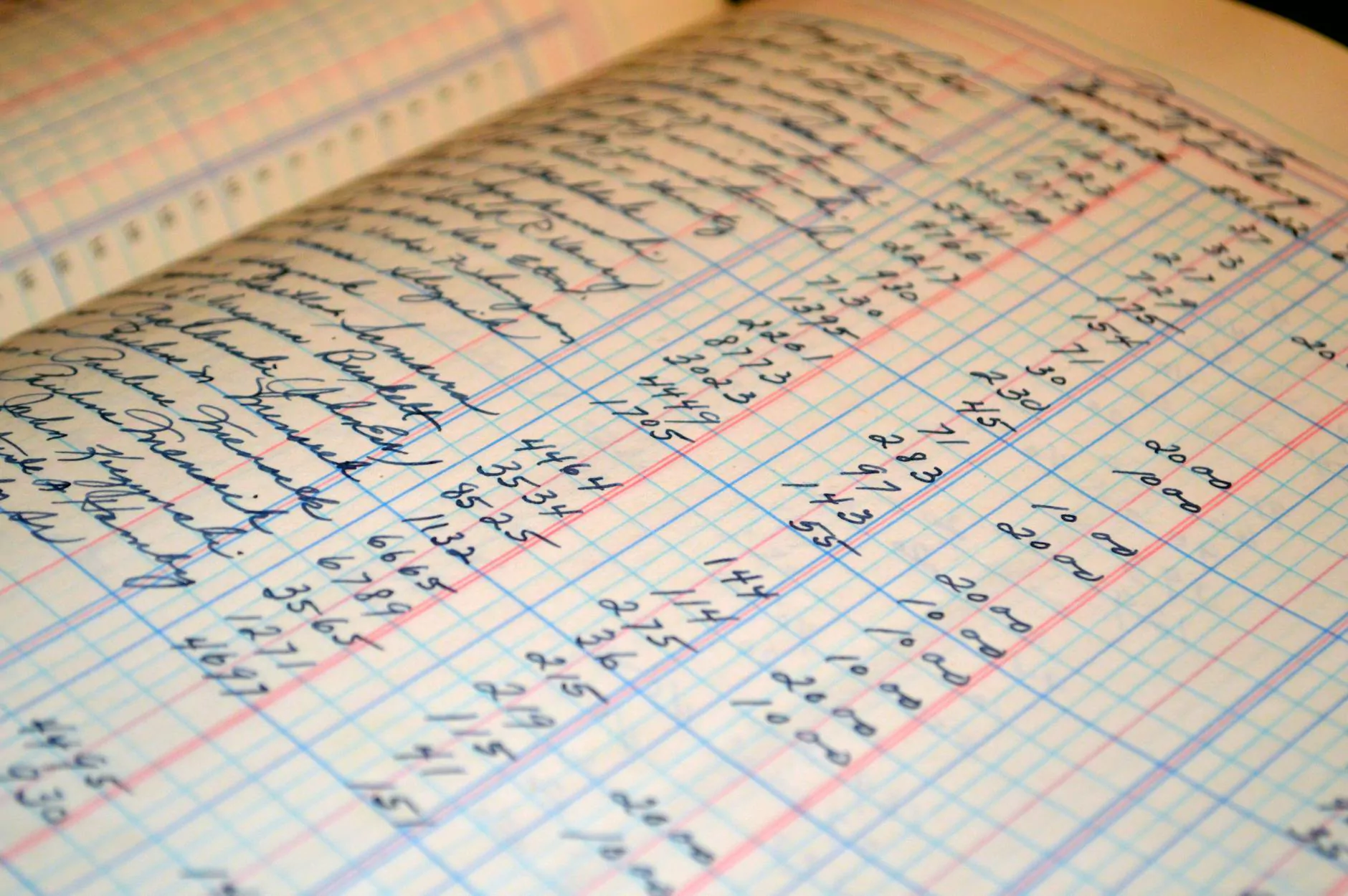

In today’s fast-paced business world, maintaining accurate financial records is not just a necessity; it's a strategic advantage. This is where full service bookkeeping comes into play. It serves as the backbone of your financial operations, providing not only organization but also insights into your business’s financial health.

What is Full Service Bookkeeping?

Full service bookkeeping encompasses a broad range of services that help manage a company's financial transactions. These services typically include:

- Recording and categorizing transactions

- Managing payroll

- Generating financial statements

- Handling accounts payable and receivable

- Tax preparation and planning

- Budgeting and forecasting

By outsourcing these critical functions to a professional accounting service, businesses can focus their energy on growth and strategic planning while ensuring that their financial records are precise and up-to-date.

Benefits of Full Service Bookkeeping

Investing in full service bookkeeping can yield substantial benefits for your business. Here are some of the most significant advantages:

1. Time Savings

Managing financial records can be time-consuming. By using a full service bookkeeping firm, you can save countless hours that can be directed towards core business activities such as sales, marketing, and customer service.

2. Increased Accuracy

Professional bookkeepers employ rigorous processes to ensure the accuracy of financial data. They are trained to identify errors, preventing costly mistakes that could impact your financial statements and tax filings.

3. Improved Financial Reporting

Full service bookkeepers generate comprehensive reports that provide critical insights into your business’s financial performance. These reports facilitate better decision-making, as you can easily track expenses, revenue, and profit margins over time.

4. Expert Knowledge

By partnering with experienced bookkeeping professionals, your business gains access to their expert knowledge. This includes awareness of the latest tax laws, accounting principles, and financial technologies that can streamline your operations.

5. Enhanced Cash Flow Management

Effective cash flow management is crucial for business sustainability. A good bookkeeping service will help you track cash inflows and outflows, ensuring you don’t run into liquidity issues.

Key Services Provided by Full Service Bookkeeping Firms

When selecting a full service bookkeeping provider, understanding the range of services they offer is essential for choosing the right partner for your needs.

Accounts Payable and Receivable Management

Timely management of accounts payable (money owed to suppliers) and accounts receivable (money owed by customers) is crucial for maintaining a healthy cash flow. Bookkeepers ensure that bills are paid on time and that invoices are sent promptly, reducing the risk of late fees and improving customer relationships.

Payroll Services

Outsourcing payroll to a bookkeeping service can alleviate the pressure of ensuring that employees are paid accurately and on time. This service often includes:

- Calculating employee wages

- Withholding taxes

- Filing payroll taxes

- Managing employee benefits

Financial Statements and Reports

Full service bookkeeping firms provide essential reports that reflect the financial standing of your business:

Balance Sheet

The balance sheet offers a snapshot of your business’s assets, liabilities, and equity at any given time, giving insights into its financial position.

Income Statement

Also known as a profit and loss statement, this report summarizes revenues and expenses over a specific period, illustrating your business's profitability.

Cash Flow Statement

This statement provides a detailed analysis of cash inflows and outflows, helping you understand your operational efficiency.

Tax Preparation and Planning

Taxes can be complex, yet full service bookkeeping firms are well-versed in the intricacies of tax regulations. They can assist in preparing your tax returns, ensuring all deductions and credits are maximized, and helping you plan for future tax obligations.

Choosing the Right Full Service Bookkeeping Provider

Selecting the right bookkeeping service is essential for ensuring your business's financial health. Consider the following:

- Experience and Expertise: Look for a provider with a strong track record in your industry.

- Range of Services: Ensure they offer all the services your business needs, from bookkeeping to payroll and tax preparation.

- Technology: A good bookkeeping service should utilize up-to-date accounting software that enhances efficiency and accuracy.

- Client Reviews and References: Check testimonials from other businesses to gauge their satisfaction with the service.

The Future of Full Service Bookkeeping

The landscape of bookkeeping is evolving, with technology playing an increasingly integral role. Automation, artificial intelligence, and cloud-based accounting solutions are transforming how bookkeeping services operate, providing real-time data tracking and reducing the manual workload.

Embracing Technology in Bookkeeping

Modern bookkeeping firms are leveraging tools such as:

- Cloud Computing: Allows for secure access to financial data from anywhere, fostering collaboration.

- Automated Invoicing: Reduces the time spent on bill collection.

- AI and Machine Learning: Enhances data analysis, enabling predictive financial modeling.

Conclusion

In conclusion, investing in full service bookkeeping is not merely an operational decision; it’s a strategic choice that can lead to substantial long-term benefits for your business. With time savings, improved accuracy, and expert insights, businesses can thrive and adapt in an ever-changing market.

Take Action Today

If you're ready to take control of your business's financial future, consider partnering with a reputable bookkeeping service like booksla.com. With their specialized financial services, financial advising, and accounting expertise, they can help you streamline your operations and achieve your business goals.